President-elect Donald Trump’s proposals would modestly cut income taxes for most middle-class Americans. But for nearly 8 million families — including a majority of single-parent households — the opposite would occur: They’d pay more.

Most married couples with three or more children would also pay higher taxes, an analysis by the nonpartisan Tax Policy Center found. And while middle-class families as a whole would receive tax cuts of about 2 percent, they’d be dwarfed by the windfalls averaging 13.5 percent for America’s richest 1 percent.

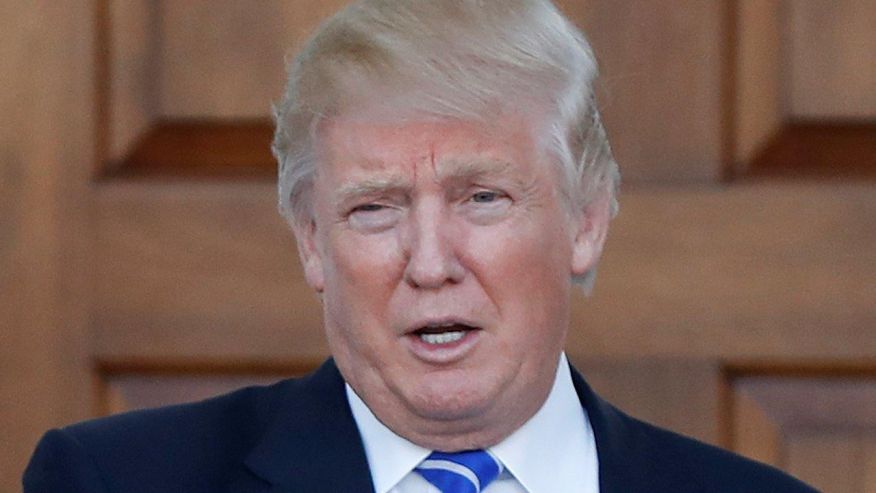

Trump’s campaign rhetoric had promoted the benefits of his proposals for middle-income Americans.

The tax hikes that would hit single parents and large families would result from Trump’s plan to eliminate the personal exemption and the head-of-household filing status. These features of the tax code have enabled many Americans to reduce their taxable income.

His other proposed tax changes would benefit middle- and lower-income Americans. But they wouldn’t be enough to offset those modifications.