The Modern Mystery

In the heart of Washington D.C., a silent war is brewing. It’s not a battle fought with armies, but with whispers, threats, and immense political pressure. The target? The U.S. Federal Reserve, the nation’s independent central bank.

Recent headlines are filled with reports of the executive branch attempting to influence the Fed’s decisions, demanding interest rate cuts and even threatening to remove board members. This isn’t just a political squabble; it’s a direct challenge to an institution designed to be shielded from the whims of politics. The very foundation of our economic stability rests on the Fed’s ability to make decisions based on data and sound economic principles, not political expediency.

As we watch this modern drama unfold, it’s easy to feel a sense of unprecedented crisis. But what if I told you this has all happened before? What if the same dangerous game of political interference in a nation’s economy was played out nearly two millennia ago, with catastrophic results? To understand the stakes of our current situation, we must journey back in time, to an era of chaos and collapse: the Roman Empire in the third century A.D.

The Time Portal

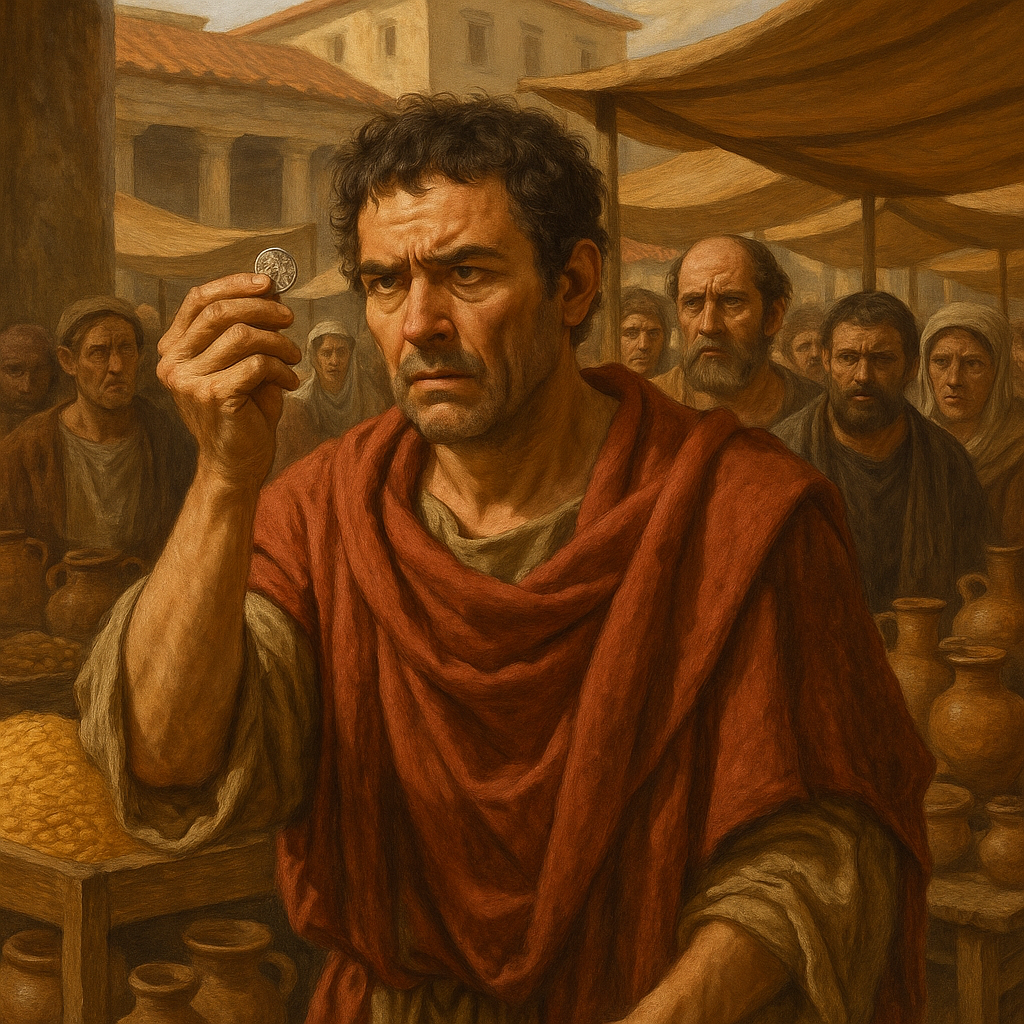

Imagine a Roman merchant in the year 270 A.D. His name is Lucius, and he’s trying to sell a shipment of grain in the bustling markets of Rome. But the once-stable silver denarius coin in his hand feels lighter than it used to. It’s no longer pure silver, but a cheap alloy, a shadow of its former self. The reason? A succession of power-hungry emperors, desperate to fund their endless wars and appease a restless military, have been secretly debasing the currency.

Lucius knows that accepting these new coins at face value is financial suicide. The value of his grain is real, but the money he’s being offered is a lie. He’s not alone. Across the empire, farmers, artisans, and merchants are facing the same dilemma. The trust that once held the Roman economy together is evaporating like morning mist.

This was the Crisis of the Third Century, a 50-year period of intense political instability, civil war, and economic turmoil. More than 20 emperors rose and fell, most of them military generals who seized power through force. Their primary concern wasn’t the long-term health of the empire, but placating the soldiers who put them in power. And the easiest way to do that was to print more money.

The Parallel Revelation

The parallels between the Roman crisis and our current situation are as striking as they are unsettling. The Roman emperors, much like some modern political leaders, saw their nation’s monetary system not as a tool for economic stability, but as a personal piggy bank to fund their ambitions. They lacked any understanding of or respect for the long-term consequences of their actions.

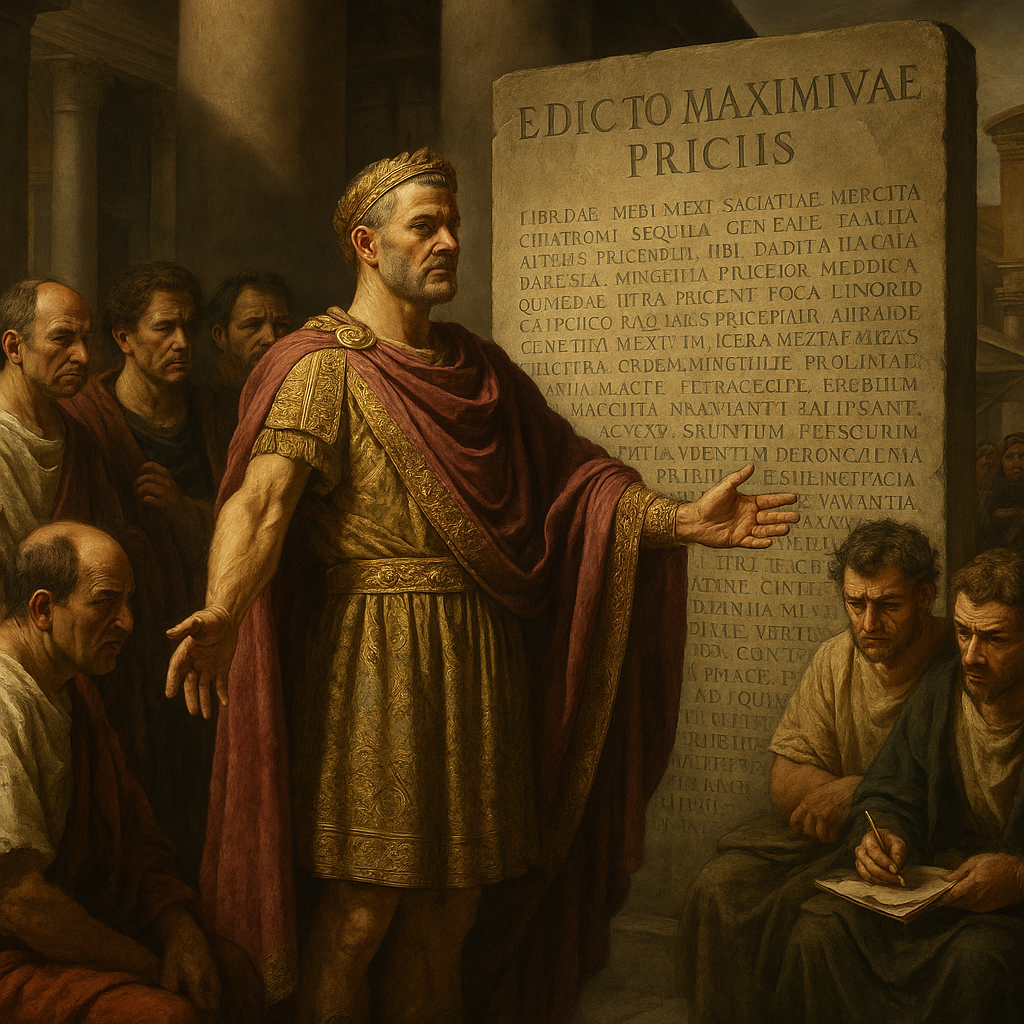

When the debased currency led to rampant inflation, the emperors didn’t reverse course. Instead, they doubled down on their disastrous policies. In 301 A.D., Emperor Diocletian issued his infamous “Edict on Maximum Prices,” a decree that set fixed prices for all goods and services across the empire. The penalty for violating the edict was death.

This is the historical equivalent of a modern government attempting to control inflation by simply ordering companies not to raise prices, while simultaneously demanding the central bank print more money. It’s an act of economic illiteracy, born of arrogance and a desperate need to maintain political control. Just as the Roman emperors blamed “greedy merchants” for the inflation they themselves had caused, we hear echoes of this rhetoric today when politicians scapegoat businesses for rising prices.

The Pattern Recognition

Why does this pattern repeat itself? Because the fundamental conflict between political power and institutional independence is timeless. Politicians, by their very nature, are focused on short-term goals: winning the next election, maintaining popularity, and rewarding their supporters. Independent institutions, like a central bank, are designed to take a longer view, to make unpopular decisions in the short term to ensure long-term stability.

When a political leader attempts to subvert an independent economic institution, they are essentially trying to sacrifice the future for the present. They are willing to risk long-term economic collapse for short-term political gain. This was the fatal error of the Roman emperors, and it’s a danger we face today.

The Roman experience teaches us that a stable economy is built on trust. Trust in the value of money, trust in the rule of law, and trust in the independence of the institutions that safeguard our economic system. When that trust is eroded, the entire system begins to crumble.

The Ancient Warning

The consequences of Diocletian’s Edict were immediate and catastrophic. Faced with the choice of selling their goods at a loss or facing execution, many producers simply stopped producing. The once-thriving markets of the Roman Empire fell silent. Shortages became rampant, and the black market, with its own set of dangers, became the only source of essential goods.

The economic interconnectedness of the empire, its greatest strength, disintegrated. People fled the cities, which had become centers of starvation and despair, and retreated to the countryside, attempting to become self-sufficient. The Roman world, once a vibrant hub of trade and innovation, retrograded into a collection of isolated, impoverished manors. This was the beginning of the end for the Western Roman Empire.

The lesson from Rome is clear: when a government destroys its own currency and attacks the very foundations of its economy, it sets the stage for its own collapse. The barbarian invasions that are often blamed for the fall of Rome were merely the final blow to an empire that had already been hollowed out from within.

5 Things Readers Can Do This Week

History is not just a collection of stories; it’s a roadmap that can help us navigate the challenges of the present. Here are five practical steps you can take this week to prepare for the potential consequences of the patterns we see repeating today:

1. **Educate Yourself on Economic Independence:** Understand why an independent central bank is crucial for a stable economy. Read up on the history of the Federal Reserve and the dangers of political interference. A great place to start is by exploring the articles on Self-Reliance Report to understand the principles of economic self-sufficiency.

2. **Diversify Your Assets:** In times of economic uncertainty, it’s wise not to have all your eggs in one basket. Learn about different asset classes, including precious metals, real estate, and other tangible assets that can hold their value even when currency is being devalued. Survival Stronghold offers excellent guides on building a resilient financial future.

3. **Build a Resilient Household:** Focus on practical skills and resources that can help your family weather any storm. This could include starting a small garden, learning basic home repair skills, or building a well-stocked pantry. Homesteader Depot is a treasure trove of information for anyone looking to become more self-sufficient.

4. **Prioritize Your Health:** A strong and healthy body is your most valuable asset. In times of crisis, access to healthcare can become limited. Focus on preventative health measures, a healthy diet, and natural remedies. Freedom Health Daily and Seven Holistics provide a wealth of knowledge on how to take control of your health.

5. **Engage in Local Community:** Strong local communities are the bedrock of a resilient society. Get to know your neighbors, support local businesses, and participate in local governance. When national institutions are in turmoil, a strong local network can provide a vital safety net.

—

This article is sponsored by 4ft Farm Blueprint. In an uncertain world, the ability to produce your own food is the ultimate form of self-reliance. The 4ft Farm Blueprint provides a step-by-step guide to creating a high-yield, low-maintenance garden in just a 4×4 foot space. Learn more at 4ftfarmblueprint.com

”’