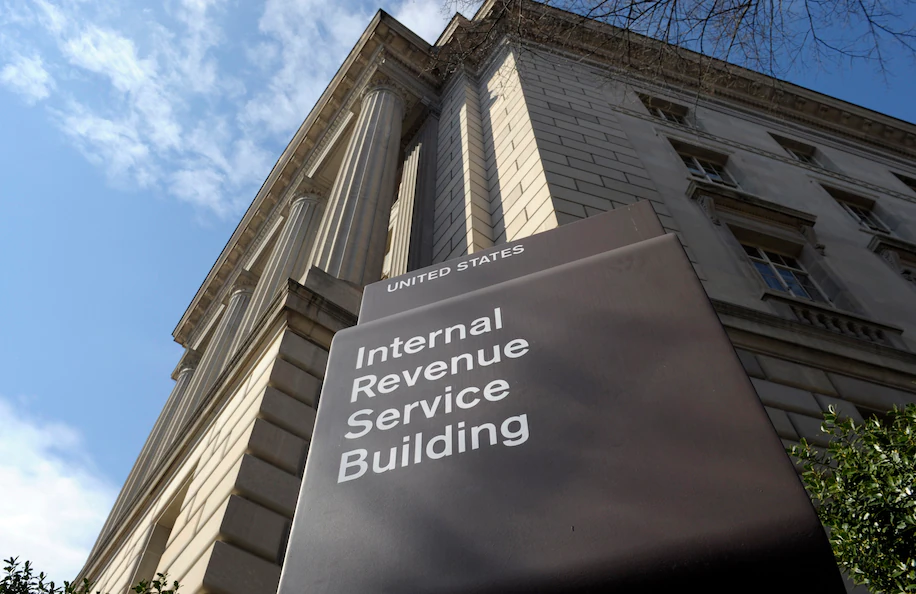

A newly empowered Internal Revenue Service is one of the keys to the sweeping climate, health care and tax bill.

The bill, known as the Inflation Reduction Act, will put $80 billion toward beefing up the IRS, in line with liberals’ long-term goals to strengthen tax collection and enforcement on corporations and high-income earners, while relieving low-income taxpayers of cumbersome and frightening audits.

The idea is that the government could bring in more money by examining corporate and high-income returns than it does by pursuing lower- or middle-income taxpayers who make mistakes on their returns or underpay their taxes by small amounts. The IRS in recent years has grown more dependent on those types of audits because they are relatively inexpensive: They’re automated, and they preserve the agency’s limited personnel resources. But they also mostly fall on taxpayers who can’t afford to fight back by spending hours on the phone with the tax agency or hiring lawyers.

Read more at Washingtonpost.com