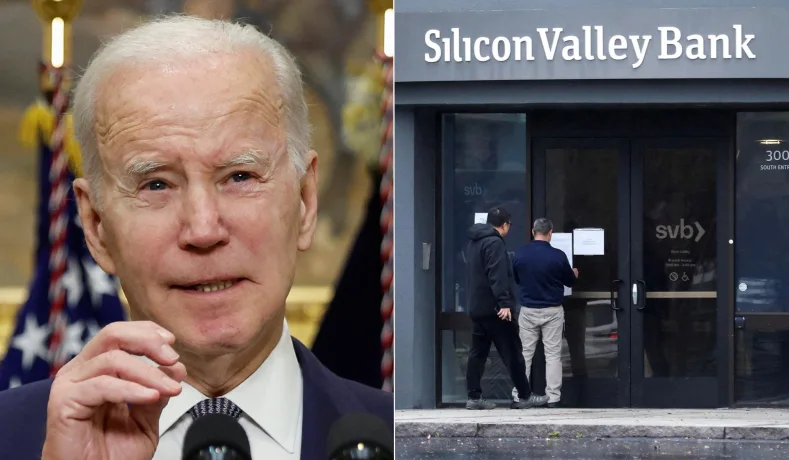

Suddenly, no one is all that certain about the financial health of regional banks in the United States. Over the course of the weekend, the collapse of Silicon Valley Bank went from a big financial story that might warrant an explainer in this newsletter to a big national story with potentially far-reaching ramifications for the U.S. economy. The collapse of the bank most tied into Silicon Valley’s high-flying world of venture capital comes on the heels of the sudden end of two banks tied into the cryptocurrency industry. The government is also pledging to guarantee the full deposits of New York-based Signature Bank; and last week, San Diego-based Silvergate Bank announced it was winding down operations and liquidating its holdings. What do those two latter banks have in common? They were the top two U.S. banks tied into cryptocurrency. In Silicon Valley’s giant game of musical chairs, the music just stopped, and everybody’s scrambling to make sure they still have a seat. The Biden administration’s solution is to throw the traditional limit on FDIC guarantees out the window and pledge that the U.S.-government-backed FDIC will make everyone whole again. Moral hazard is back, baby.

Trad more at NationalReview.com