The number of people 60 and older with student loan debt has quadrupled in the past decade, and older Americans now represent the fastest-growing segment of the U.S. student loan market, according to a new report by the Consumer Financial Protection Bureau.

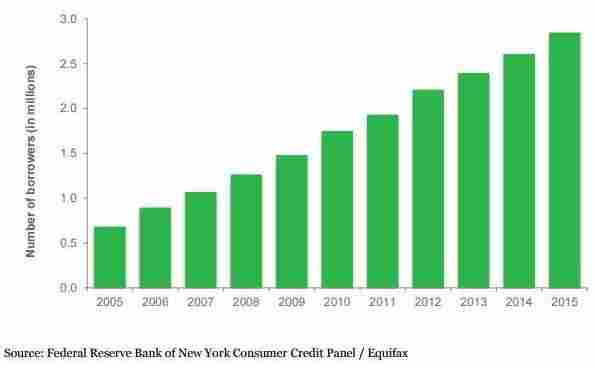

As of 2015, more than 2.8 million Americans over 60 had outstanding student loan debt — up from some 700,000 in 2005.

The vast majority are loans taken out by parents or grandparents to finance education opportunities for young people, with 73 percent of borrowers over 60 reporting that their student loan debt is owed “for a child’s and/or grandchild’s education.”

Many private student loans require students to apply jointly with a co-signer or co-borrower, the report notes, and more than half of co-signers are over 55.

The average amount owed has also increased dramatically. In 2005, the average amount owed by borrowers 60 and older was about $12,000. In 2015, it was more than $23,000.