Vice President Kamala Harris, who hasn’t released a detailed economic plan, would have to thread the needle between a pair of seemingly contradictory tax pledges if she wins the election.

Her campaign says she’s keeping President Joe Biden‘s promise not to raise taxes on anyone making under $400,000. However, she also appears to be keeping Biden’s promise to let the 2017 Trump tax cuts “stay expired” when portions of the law lapse next year.

That expiration would raise taxes on middle-income earners in the absence of new legislation. The 2017 overhaul included lower tax rates, an enlarged child tax credit, a doubled standard deduction, and many other provisions that, on balance, cut taxes for people below the $400,000 threshold.

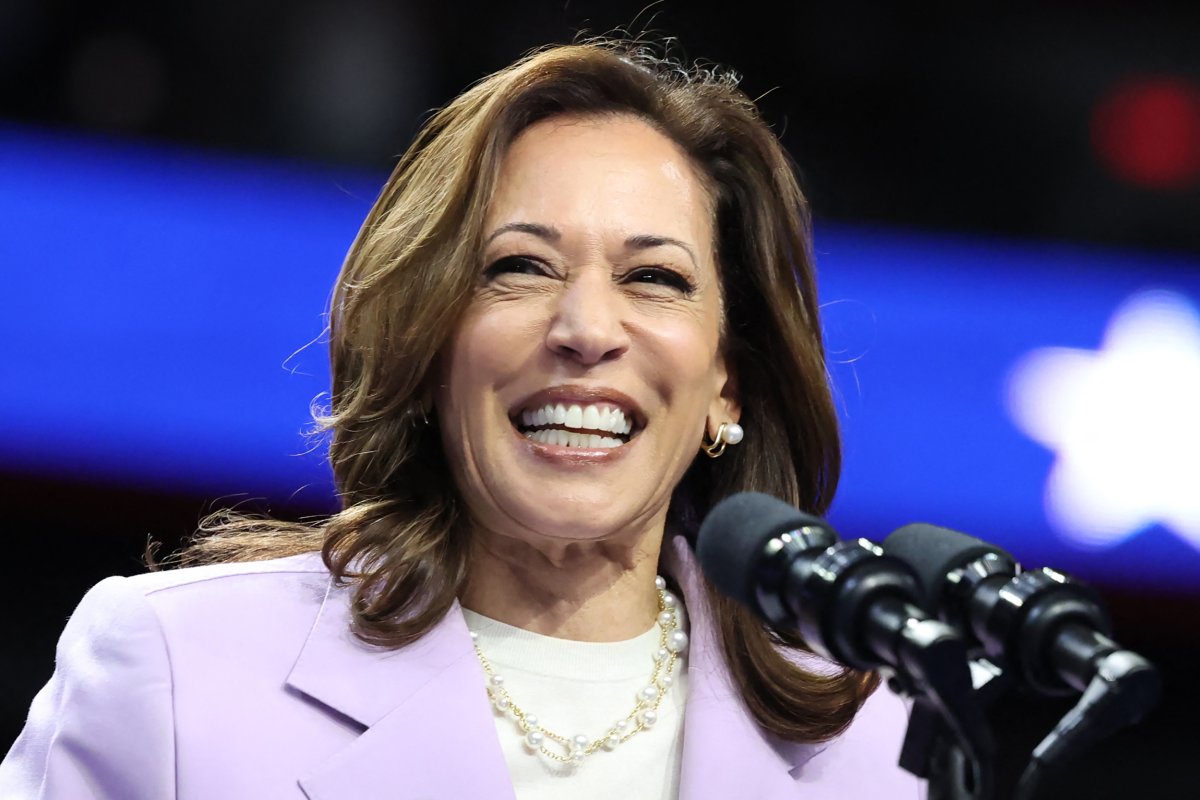

“We believe in a future where every person has the opportunity not just to get by but to get ahead,” Harris said at a Wisconsin campaign rally in late July. “Building up the middle class will be a defining goal of my presidency.”

While Democrats have almost universally attacked the Tax Cuts and Jobs Act, better known as the Trump tax cuts, as a giveaway to the rich, it did include cuts for the lower and middle classes.

A contemporary analysis of the 2017 tax code rewrite from the Tax Policy Center, a center-left nonprofit research organization, found that it would cut taxes across the income spectrum. A score of the bill from the Joint Committee on Taxation, which provides tax analysis for Congress, found that majorities of middle-income households would see significant tax cuts. A report from the Congressional Budget Office, Congress’s nonpartisan in-house group of budget experts, indicated that the law reduced tax rates for all groups in 2018.

Thus, if elected, Harris would either need to extend the cuts or work with a possibly divided Congress to craft a new tax bill.

Read more at Washingtonexaminer.com